Find the best Retail POS Systems

Compare Products

Showing 1 - 20 of 1518 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

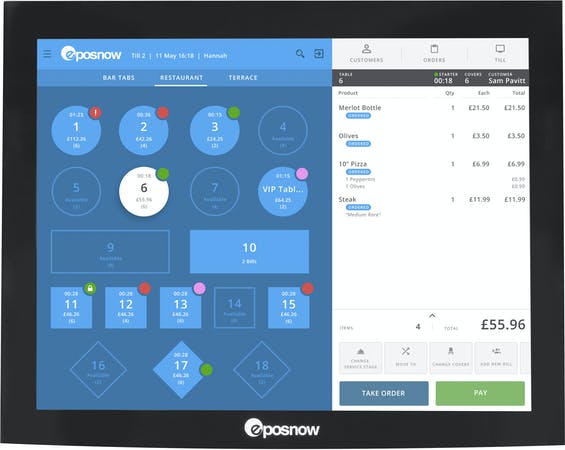

Epos Now

Epos Now

Epos Now POS systems are an effective business management, sales, and payment solution for single-site, multi-site, and online businesses. Popular with retailers and hospitality businesses in many industries, Epos Now POS systems ...Read more about Epos Now

NetSuite

NetSuite

With an integrated system that includes ERP, financials, commerce, inventory management, HR, PSA, supply chain management, CRM and more – NetSuite enables fast-growing businesses across all industries to work more effectively by a...Read more about NetSuite

AmberPOS

AmberPOS

Pacific Amber’s AmberPOS offers a point of sale software solutions to a variety of retail specialties, ranging from small to midsized, in the United States and Canada. In addition to point of sale functionality, AmberPOS incl...Read more about AmberPOS

Rain POS

Rain POS

Rain is an all-in-one point-of-sale, website, and marketing system for small to midsized retailers. Music, dive, sporting goods, paddle, craft, sewing, quilting, and clothing boutiques will find Rain is an excellent fit for their...Read more about Rain POS

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many stores do you have?

Toast POS

Toast POS

FrontRunners 2024

Toast POS is a flexible system built exclusively for restaurants and the food service industry. Offering tools like online ordering, delivery, takeout, mobile app ordering, contactless payments, and e-gift card purchasing, this so...Read more about Toast POS

Lavu POS

Lavu POS

Lavu is a Point of Sale solution designed for use by restaurants, bars, and nightclubs - from full-service, quick-service, and franchise restaurants, to food trucks, coffee shops, and lounges. Users can choose between bar, restaur...Read more about Lavu POS

Agiliron

Agiliron

Agiliron is an all-in-one Retail Management System which allows you to manage all orders, inventory and CRM records, from all channels, in one place. Agiliron also integrates with many of your existing business tools like Quickb...Read more about Agiliron

CAKE POS

CAKE POS

CAKE provides an easy-to-use POS that owners will learn like a pro in a short amount of time. The restaurant management system takes care of everything in one place with integrated online ordering, curbside pickup, reservations, ...Read more about CAKE POS

Epicor for Retail

Epicor for Retail

Epicor retail POS and business management solutions are designed to help independent retailers work smarter, not harder. With more than 45 years of experience built-in, Epicor retail solutions help retailers in nearly 8,000 locati...Read more about Epicor for Retail

Star-Plus

Star-Plus

Auto-Star’s point of sale solutions are trusted by thousands of grocery, pharmacy and natural health retailers all over North America. Our industry-leading POS solutions keep our clients ahead of the curve and stand out from the r...Read more about Star-Plus

Pomodo POS

Pomodo POS

Pomodo POS is a point-of-sale (POS) solution that helps businesses manage payments and customers. Users can control which departments, categories, and products show up on a register. The solution assists organizations with invent...Read more about Pomodo POS

TouchBistro

TouchBistro

TouchBistro is an all-in-one POS and restaurant management system that makes running a restaurant easier. Providing the most essential front of house, back of house, and guest engagement solutions on one powerful platform, TouchBi...Read more about TouchBistro

Rezku POS

Rezku POS

Rezku is the premier POS, used by successful restaurants, bars and pizzerias to compete at a higher level, earn new business and eliminate headaches. Rezku comes complete with everything modern food and beverage concepts need for...Read more about Rezku POS

DaySmart Salon

DaySmart Salon

DaySmart Salon (formerly Salon Iris) offers packages designed to fit the needs of beauty businesses of all sizes. Simple subscription plans enable savvy salon managers to optimize their day-to-day operations and expand their br...Read more about DaySmart Salon

KORONA POS

KORONA POS

FrontRunners 2024

KORONA POS provides point of sale software, inventory management, and CRM services for all types of retailers, such as convenience stores, liquor shops, and QSRs. The POS software also caters to museums, theme parks, and wineries ...Read more about KORONA POS

Bravo Store Systems

Bravo Store Systems

Bravo Store Systems empowers small businesses innovative point of sale solutions. Bravo is the leading provider of an all in one Point of Sale (POS) solutions tailored for a diverse range of industries. With a deep understanding...Read more about Bravo Store Systems

Ordorite

Ordorite

Ordorite offers a fully end-to-end management software solution for furniture, bedding and related retailers. The system can manage every aspect of your business from point of sale, inventory control, warehouse management, deliver...Read more about Ordorite

Liberty Consignment

Liberty Consignment

With the Liberty Consignment Software, your success is our mission. Resaleworld.com has been instrumental in the Resale industry for over 30 years, and continues to design and develop a comprehensive software product that has help...Read more about Liberty Consignment

MyPOS Connect

MyPOS Connect

Designed for independent and enterprise retailers, MyPOS Connect is a SOC2 compliant, cloud-hybrid POS solution that allows businesses to create a POS experience for any retail business function and optimize customer engagement, s...Read more about MyPOS Connect

PrecisionERP

PrecisionERP

PrecisionERP is an all-in-one business software solution seamlessly integrates Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and Asset Management functionalities. This unified platform empowers busine...Read more about PrecisionERP

Popular Comparisons

Buyers Guide

Last Updated: January 09, 2024Here's what we'll cover:

What is a retail point of sale (POS) system?

Benefits of retail POS software

Competitive advantages of using retail POS software

Business sizes using retail POS software

Software related to retail POS

What is a retail point of sale (POS) system?

A retail POS system is any technology that includes software where a retail transaction is completed. It provides capabilities such as scanning a barcode, making a purchase order or printing a receipt. Features include inventory management, sales reporting, and analytics. The software also helps retailers nurture relationships with customers by providing customer relationship management (CRM) tools.

Benefits of retail POS software

Retail POS systems bring many benefits to retailers aside from simply completing transactions. These include:

Sales reporting and analytics: Provides retailers with insight into their sales, helping them make informed decisions that strengthen the business.

Inventory management: Automates stock control and helps retailers determine optimal product counts and when and how to reorder top selling products.

Customer management capabilities: Help retailers automatically record and track valuable customer information, enabling stronger relationships and encouraging repeat business.

Competitive advantages of using retail POS software

Surprisingly, many retailers we work with at Software Advice have survived without software. In fact, 64 percent of single-store retailers we work with are operating without retail POS systems in place.

But Excel spreadsheets can only go so far in supporting the operational processes retailers need to accomplish every day. As retailers grow, software can:

Scale the business: Key insights provided by a POS solution can help retailers identify the strong points of their business. This information can be used to pinpoint top-selling products and the most valuable customers to focus on in order to scale.

Operate more efficiently: The operational efficiencies and automations provided by retail POS systems enable shop owners, operators and managers to spend more time training employees and interacting with customers.

Business sizes using retail POS software

The POS market easily accommodates retailer demographics ranging from small retail store operations to large enterprise retailers.

Small: If you operate a single store, or even just do pop-up events, you're likely best suited for a basic POS system with limited hardware and advanced features.

Medium: If you operate a growing, high-volume single store or up to five stores, you're best suited for a POS system that enables multiple location management and features advanced reporting and analytics.

Large, enterprise: If you operate a chain of five or more stores, you're best suited for an enterprise POS system with enterprise resource planning support, including warehousing, shipping logistics and advanced analytics.

Software related to retail POS

Many retail POS systems on the market today offer retailers with all the critical capabilities packaged into one solution. However, if a core capability that retailers need is missing from their POS system, they'll want to look to specialized software to fill the void. Popular specialized software includes:

Inventory management for maintaining desired product counts.

Sales reporting and analytics for pinpointing key performance indicators.

Customer relationship management (CRM) for generating customer loyalty.

Accounting for managing payroll, taxes and other accounting.

Ecommerce for setting up an online store.

Aside from software for specialized functionalities, retailers might want to consider software designed specifically for the unique needs of their business. For example:

Restaurant and foodservice business owners often require restaurant software to process orders, print tickets, analyze ingredient availability and determine how much to charge for meals.

Jewelers might need jewelry POS software to manage repairs and quotes, in addition to processing sales and inventory tracking.

Consignment, pawn shop and resale store owners need specialized software since they don't own their inventories. These retailers need software with functionality tailored to their store types.

Features guide

Common retail POS feature overview

Here are four common features that most POS systems offer:

For greater features detail, check out our "What Is A Point of Sale System?" article.

Feature details and examples

Here are some examples showing the top common features of POS solutions:

Reporting and analytics: Highlights key data. Enables insight into sales data. Supports data filtering options for pinpoint analysis.

Reporting and analysis by Lightspeed Retail (Source)

Customer management: Helps retain valuable customers. Create and manage customer profiles. Track valuable contact information and purchase histories. Send personalized marketing and deals.

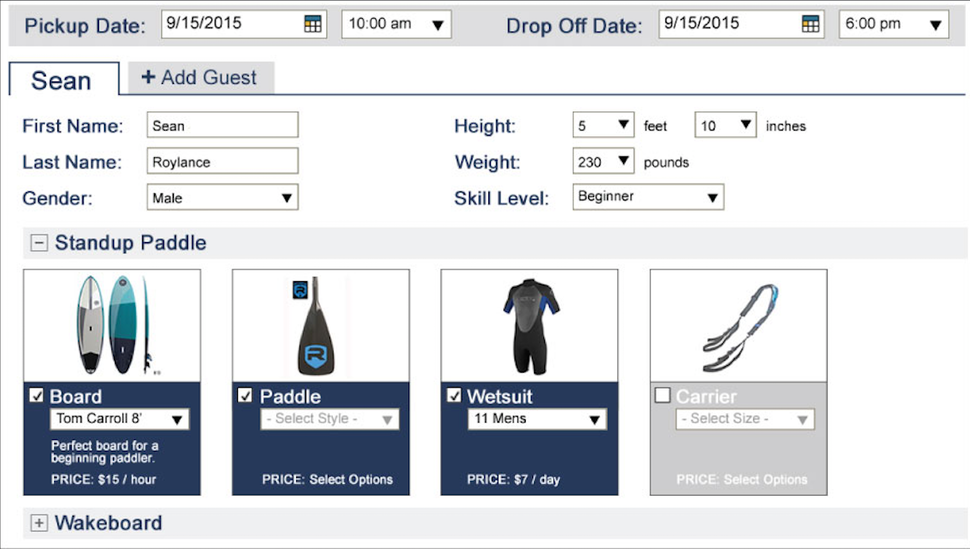

Customer profile in Rain POS (Source)

Inventory management: Automates the management of supply levels. Deducts inventory as sales are completed and provides alerts when inventory levels reach pre-defined thresholds. Also provides reports on inventory movement trends.

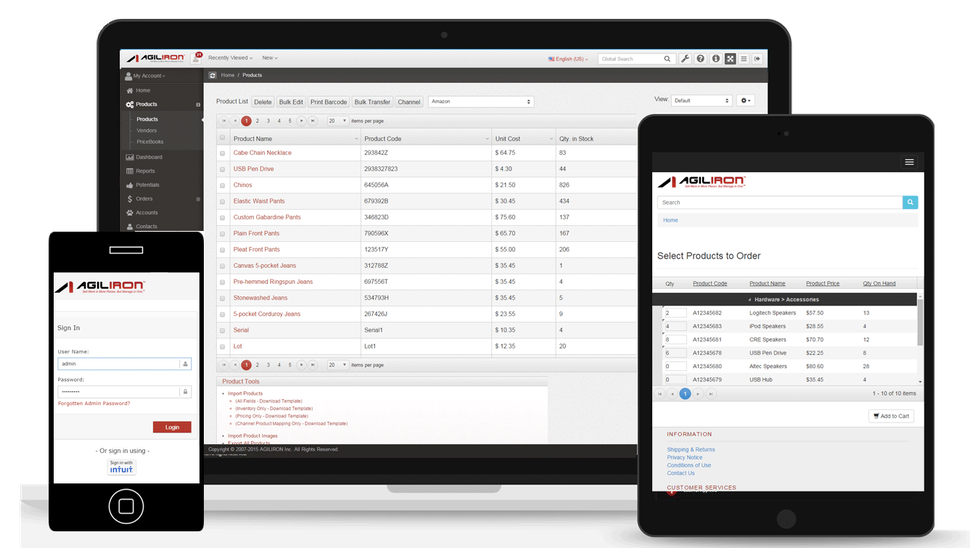

Inventory management in Agiliron (Source)

Employee management: Optimizes scheduling and tracks commissions (when applicable). Provides employee logins to enable clocking in/out for shifts.

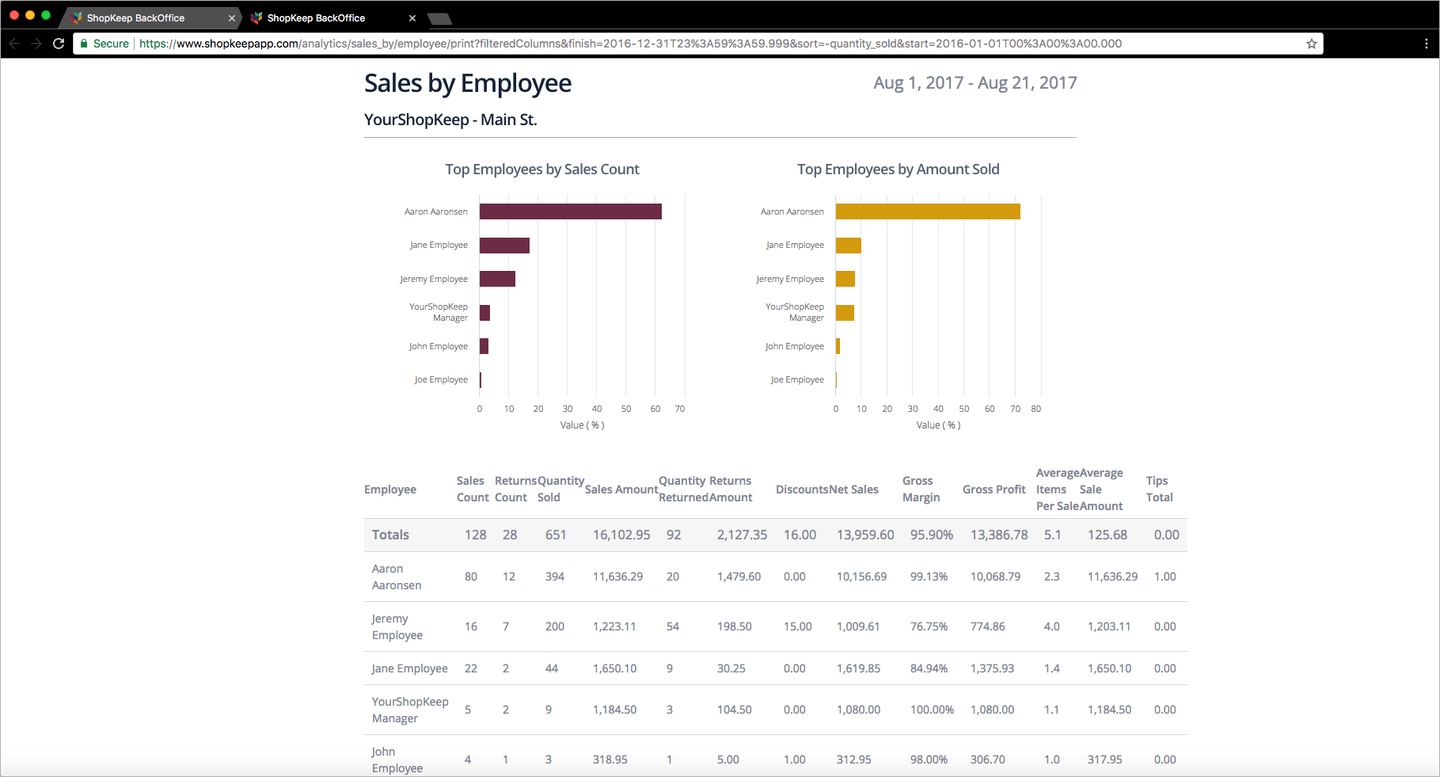

Employee management by ShopKeep (Source)

Payment processing: Accepts payments from multiple modes such as credit card, debit card, e-wallet, and cash.

Processing payments in Epos Now (Source)

Some retail POS solutions also offer the following advanced features:

Ecommerce: Many of the top POS players on the market today offer some form of e-commerce integration, either within their system or through a specialized e-commerce platform.

Accounting: Manages the process of generating customer invoices and receiving payments as well as tracking all payments made to partners and vendors.

Purchase orders: Tracks items and amounts ordered, including date of order, shipping information and progress.

Loyalty program: Manages and tracks customer loyalty by providing rewards or points for purchase frequency or other incentive goals.

Targeted marketing: Allows retailers to segment customers and create mailing lists based on custom criteria such as items purchased, total amount spent etc.

Loss prevention: Monitors inventory levels and purchase orders and reports discrepancies or missing quantities.

Variable pricing: Allows managers to automate the process by which varied prices are assigned to products, typically based on walk-in/phone orders, time of day or season.

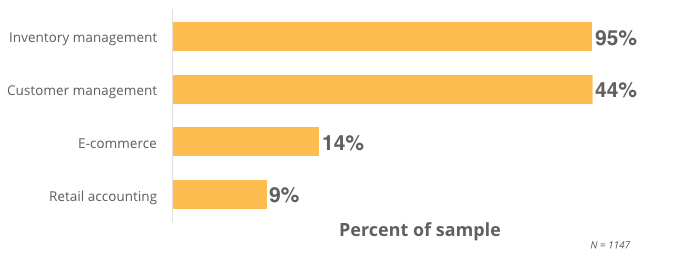

Retail POS buyers' top requested features

Our advisors at Software Advice have helped thousands of SMB retailers find the best POS system for their unique business needs. We're able to analyze these consultations to determine trends in POS needs.

According to this analysis, these are the top requested POS solution features by your SMB retail peers:

The retail POS software features you really need

Depending on the number of stores your business is operating, certain software capabilities take priority over others. Here are some must-have retail POS features for retailers at different stages of business:

Independent retailers not operating an actual store | Payment processing: Just need the bare-bone ability for retailers to manage transactions and checkout customers. |

Single-store retailers | Sales reporting: Identify key performance indicators within the sale system and pinpoint top selling items to help drive more business. |

Multi-store retailers | Multi-store merchandise management: Enables creation of the optimal balance of SKUs. Provides analytical tools to plan merchandise based on sales histories, trends and forecasts. |

Enterprise retailers | Shipping and transportation management: Helps organizations efficiently transport inventory from distribution centers to store locations and customers. Enables enterprises to plan shipments via air, land or sea with their own or via third-party fleets. |

Pricing guide

For an accurate snapshot of what retail POS systems cost, download our Pricing Guide.

FAQs

What questions should I ask vendors when evaluating retail POS products?

Here are some key questions you need each vendor to answer when evaluating their POS offerings:

Does the functionality of the system suit your specific business needs?

Create a list of must-have functionality that you need your new POS system to do. Walk through each of these with each vendor and record how many each system offers.

How much does the software really cost?

You don't want to be sold on a system based on inaccurate pricing. Figure out how much each system will cost over the next three months, six months and year.

Is your only option to sign a contract?

You don't want to be stuck paying for an inadequate system, so see if there's a monthly subscription you can agree to rather than committing to paying for a system for a year or more.

Are there any hidden fees?

Many POS system costs include payment processing fees. Some even include fees for upgrading or for tech support. Figure out all the potential costs before committing to a system.

Is any POS hardware proprietary?

POS hardware is often just as important for a retailer as the software it supports. Determine if you're required to purchase hardware through POS vendors (which is often marked up).

Do I have options for my merchant service provider?

Merchant service providers (MSP) are a critical partner for SMB retailers. Some POS systems allow you to work with whichever MSP you prefer, while others require you to work with their partner MSPs.

What hardware do I need for my retail POS system?

These are the critical hardware tools you need to get the most out of your POS system:

Register screen: Displays transaction information and product database. Visual hub of a POS system. iPads and other tablets are replacing bulky, traditional monitors.

Barcode scanner: Automatically pulls product details, and adds price to transaction total. Adjusts inventory level once transaction is complete.

Credit card reader: Processes credit, debit and gift cards. Most new readers accept EMV readers as well as enable mobile payments (Apple Pay, Android Pay).

Receipt printer: Paper receipts provide customers with data on their purchase. Phasing out in exchange for email and text receipts.

Cash drawer: A secure place to house cash from payments.

Tips & tools

Build a business case for retail POS software

If you're having trouble justifying the purchase of a new POS system for your business, take a look at this narrative to see how beneficial such a system can be.

Relevant articles

Here are some recent articles about retail POS systems you should check out:

"What Is a Merchant Service Provider—And Why Do They Matter?"

"Improve Customer Experience in Retail Stores With New Technologies"

Popular Retail POS System Comparisons

There are many POS systems on the market that might work for your business, so we've included the following pages for you to see detailed comparisons of a few top systems: