Find the best Supply Chain Management Software

Compare Products

Showing 1 - 20 of 2227 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Alvys

Alvys

Alvys is a modern cloud-based TMS. It simplifies everything from quotes to cash with its forward-thinking carrier, broker, and hybrid workflows. The best part? Their native EDI solution. Say goodbye to EDI headaches - Alvys has tr...Read more about Alvys

Shipedge

Shipedge

The Shipedge Platform was created to solve the challenges associated with the complete order management lifecycle and supporting activities. We’re dedicated to providing innovative solutions to make commerce easier and more connec...Read more about Shipedge

Leanafy

Leanafy

Leanafy WMS is a cloud-based solution that will help you manage your warehouse and inventory processes more efficiently. The solution provides real-time visibility into your orders, shipments, and inventory levels so that you can ...Read more about Leanafy

Rose Rocket

Rose Rocket

Rose Rocket TMS is a transportation management software built for modern trucking companies and brokerages. The software helps you input orders, generate contracted rates and spot quotes, track & trace shipments, manage documents,...Read more about Rose Rocket

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Meet Eric, a software expert who has helped 1,534 companies select the right product for their needs.

Talk with us for a free

15-minute consultationSoftware Advice is free because vendors pay us when they receive sales opportunities.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

This allows us to provide comprehensive software lists and an advisor service at no cost to you.

Tell us more about your business and an advisor will reach out with a list of software recommendations customized for your specific needs.

STEP 1 OF 4

How many employees are in your company?

Advatix Cloudsuite

Advatix Cloudsuite

Advatix Cloudsuite (ACS) is a comprehensive suite of cloud-based products and tools designed to optimize and streamline supply chain and business operations across various industries. Leveraging cutting-edge technology, ACS helps ...Read more about Advatix Cloudsuite

Item

Item

Item is a cloud-based solution that helps streamline supply chain and warehouse management. In-depth, real-time visibility is at the heart of Item's features, providing a comprehensive view of warehouse activities, inventory, empl...Read more about Item

Excalibur WMS

Excalibur WMS

Excalibur WMS by Camelot 3PL is a cloud-based or on-premise warehouse management solution (WMS), designed exclusively for third-party logistics (3PL) warehouses and fulfillment operations. Excalibur is customizable for a variety o...Read more about Excalibur WMS

Tecsys Elite

Tecsys Elite

Tecsys’ Elite™ provides a series of cloud-based supply chain management solutions suitable for midsize to large distribution companies. The company currently services a wide range of verticals such as healthcare, service parts, he...Read more about Tecsys Elite

NetSuite

NetSuite

With an integrated system that includes ERP, financials, commerce, inventory management, HR, PSA, supply chain management, CRM and more – NetSuite enables fast-growing businesses across all industries to work more effectively by a...Read more about NetSuite

Stord

Stord

Stord is a cloud-powered supply chain management solution designed to assist businesses in enhancing their logistics and transportation processes through a unified platform. It supports enterprises in refining their workflow acros...Read more about Stord

WithoutWire

WithoutWire

The WithoutWire Inventory Platform WMS is built for complex inventory management. With one mobile app that can be deployed across iOS and Android platforms, rugged or consumer devices, our Inventory Platform WMS is easy to integra...Read more about WithoutWire

MyCarrierTMS

MyCarrierTMS

MyCarrier was formed, inspired, and driven by the shipping and logistics digital innovation possibilities. We aspire to be the ubiquitous platform that connects customers and carriers instantly and without barriers to fuel the fut...Read more about MyCarrierTMS

ContractWorks

ContractWorks

ContractWorks is contract management software designed to address the signing, tracking, and managing of corporate agreements. ContractWorks features a centralized, searchable repository for contracts, and includes helpful feat...Read more about ContractWorks

CobbleStone Contract Insight

CobbleStone Contract Insight

CobbleStone Contract Insight provides enterprise CLM software that has been selected by thousands of contract and procurement professionals spanning the globe. CobbleStone’s award-winning software, Contract Insight, is fully confi...Read more about CobbleStone Contract Insight

FreightPOP

FreightPOP

FreightPOP is the leading software in the logistics and supply chain management sectors, offering a comprehensive, cloud-based 5-in-1 platform that expertly caters to a wide range of shipping and transportation management needs. T...Read more about FreightPOP

PCS TMS

PCS TMS

PCS TMS for Shippers and Carriers offers seamless management of your entire transportation network from the Cloud. The cloud-based TMS is intuitive, efficient and affordable for shippers, carriers and asset-based brokerages of all...Read more about PCS TMS

ContractSafe

ContractSafe

ContractSafe is a cloud-based contract management solution suitable for businesses of any size. Key features include document management, contract management, key date alerts, permissions and reporting and analytics. Contract...Read more about ContractSafe

Infoplus

Infoplus

Infoplus WMS is a web-based warehouse management software solution for small to midsize 3PLs, eCommerce Retailers, and Wholesalers focused on taking control of overall inventory, warehouse operations and shipping. Key featur...Read more about Infoplus

Gatekeeper

Gatekeeper

Gatekeeper is the Vendor & Contract Lifecycle Management Platform trusted by Flo Health, Sumup, Starling Bank, and Karyopharm. Gatekeeper helps customers regain control of everything from contract approval to vendor onboarding & s...Read more about Gatekeeper

Kechie

Kechie

Kechie Distribution Management efficiently manages internal and external resources. Suited for growing businesses, the management tools provide control of replenishment, warehouse management, pick, pack, and ship, procurement, pro...Read more about Kechie

Popular Comparisons

Buyers Guide

Last Updated: March 16, 2023While the supply chain management software market is relatively small (compared to many other markets), the vast disparity in functionality between different SCM programs makes buying decisions much more complicated. Some programs concentrate on business intelligence, others focus on inventory control or transportation management and there are full-suite systems that do all of the above and more. This buyer’s guide is designed to identify the features associated with supply chain management systems to help navigate the selection process.

Here's what we'll cover:

Common Features of SCM Software

What Is SCM Supply Chain Management Software?

Supply chain software is a software program or module designed to control end-to-end business processes across the supply chain, perform demand planning and forecasting, and manage supplier relationships. While functionality in these systems varies tremendously, common features include:

Execution-focused applications (e.g., warehouse and transportation management)

Many supply chain management systems include forecasting, which helps companies manage the fluctuations in supply and demand by using sophisticated algorithms and consumption analysis to evaluate buyer histories. Supply chain optimization software can be an invaluable tool in maximizing production efficiency and planning for the future.

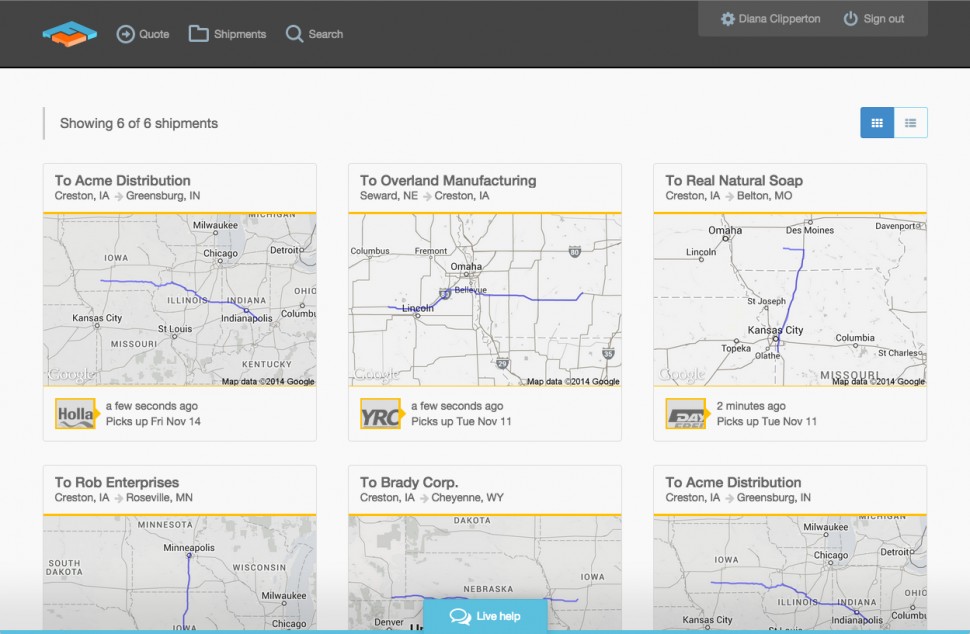

Screenshot of Freightview shipment overview dashboard

Common Features of SCM Software

Planning systems are used to forecast customer demand and adjust the speed and flow of production accordingly. Simulated demand estimates are run using historical trend data and planned promotion schedules to determine how changes in market awareness will affect your organization's inventory requirements in the future. Example vendors include InStyle ERP, SCP 4.0, VISION SCM and Clever. | |

Demand planning software improves the accuracy of potential demand forecasts by reducing biases in the data and providing that data to your organization in real-time. Multi-dimensional forecasting allows users to view information through a variety of different filters—by market, time or customer—and run a series of "what if" simulations to project future demand. Example vendors include Microsoft Dynamics, Geneva BMS, Fishbowl Inventory and SAP. | |

Vendor managed inventory (VMI) systems give suppliers the ability to monitor and replenish the buyer's inventory themselves. Various communication options—such as XML, Web portals and email—help multiple business partners increase visibility. Buyers can automate sold inventory reports, and suppliers respond with new shipment notifications and invoices. Example vendors include Datalliance VMI, RedPrairie, SAP and Aravo. | |

Buyers use supplier relationship solutions to monitor the performance of their suppliers. Users can assess supplier risk through user-defined risk categories. Performance analyses utilize key performance indicators (KPI) and audit trails to monitor spend and supplier performance. The software also helps users keep track of their suppliers' regulatory compliance. Example vendors include R.Portal, Geneva BMS, Fishbowl Inventory and S2K. Businesses likely to scale might also be looking for a system with more complexity such as vendor management systems. | |

Procurement software carries out purchase orders and maintains the financial side of supplier/customer relationships. Purchasing terms are distributed electronically throughout the organization for instant approval, and expenses are logged for future reference in the next sourcing cycle. As the accounting segment of SCM systems, procurement also handles reporting and compliance issues. Example vendors include Coupa, SphereWMS, Microsoft Dynamics and WISE. | |

Sourcing software is used before the procurement process to establish cost-cutting goals and to pre-screen potential vendors. Spend analysis pinpoints unnecessary costly supplier relationships by comparing current spend to other market options. Buyers can submit e-RFx, electronic requests for x (quotes, proposals and other information), to potential vendors to gather data for making informed purchases. Example vendors include ShippersEdge, Aravo, Epicor and Lawson. | |

WMS systems monitor and control the movement of materials within the warehouse. Shipping and receiving events are controlled with advanced shipment notifications, and picking and putaway are tracked using tools like auto ID data capture (AIDC) and radio-frequency identification (RFID). WMS software also assists with the design of warehouse infrastructure. Third party logistics companies should review our 3PL software guide for a list of systems tailored for 3PL. Example vendors include SphereWMS, WISE, HighJump Warehouse Advantage, Manhattan Associates and RedPrairie. | |

TMS software guides the movement of materials to and from the warehouse. Logistics software can suggest the most efficient delivery modalities (air, land, sea) and manages multiple delivery variations like heterogenous vehicle fleets and load splitting constraints. Deliveries are monitored using satcomm and other communication devices. Land-based fleets should review our fleet management software guide for the top trucking, dispatch and routing software as well as systems to manage overall operations. | |

This software helps supply chain managers decrease lead times on production orders, resulting in smooth quote to cash processes. The system can determine whether build-to-order (BTO) or engineer-to-order (ETO) is the best solution for each product. After order completion, order fulfillment software keeps track of unpaid orders through revenue recognition processes.Order fulfillment applications are often bundled in to broader order management systems. Example vendors include SphereWMS, ShipppersEdge and ShipSoft. |

What Type of Buyer Are You?

Third party logistics. Companies that manage the ordering, warehousing and transportation of supplies for another business need a robust solution that can handle the data and processes for lots of different companies. These supply chain management tools will include lot tracking, customer profiling, supply management and order fulfillment.

Manufacturing. Manufacturing software needs to be able to track suppliers, costs and customers. This is where features like collaboration, demand planning and strategic sourcing are most likely to be used.

Distribution. Distributors sit in the middle, connecting manufacturers to retailers and/or consumers. Distributors need to track products and terms for multiple suppliers and customers, and have robust inventory and transportation capabilities in order to ensure the products get to the right person at the right time. Freight brokers and forwarders also fit into this category, and they typically rely on specialized software that facilitates daily freight operations.

Retailers. Brick and mortar retailers will want to consider dedicated retail software, but phone—and Internet—order retailers function more like distributors. These buyers will need warehouse and transportation solutions, inventory control and possibly additional strategic/planning modules, particularly for the larger/volume-based retailers.

Market Trends to Understand

Online purchases. Over the last decade, online retail sales have exploded, and with them the need for effective warehousing, inventory and transportation control. Suppliers, more often than not, are taking a product from manufacturing not to a store, but to a warehouse where it is stored and ultimately sent directly to the consumer. Ensuring an effective inventory control path is absolutely critical throughout this process.

Software as a service (SaaS). Cloud-based software—that is, software that’s hosted by the vendor and accessed through a Web browser rather than being installed on a local computer—has been adopted by most industries to a large extent. SCM technology has been a little slower to adopt this trend, with major players like Microsoft, Geneva Systems, WISE and Fishbowl yet to develop Web-based systems. But as the technology improves, more and more supply chain management software providers will offer Web-based applications, with its benefits of collaborative networks and online purchasing integration. Currently, S2K and SAP are the biggest SaaS contenders.

Eco-friendly logistics. With environmental consciousness at an all-time high, consumers are beginning to think about logistics when it comes to purchasing their products. This trend is most noticeable in the food industry, where grocery stores and restaurants are beginning to brand and market products under a banner of being “locally sourced.” As transportation from suppliers is the easiest place for a manufacturer to cut its carbon footprint, buyers may want to look out for a program’s ability to identify suppliers based on proximity or other green factors.

Improving business intelligence. More and more companies want to know how their business spends money, so sophistication of planning, demand planning and strategic sourcing capabilities will only grow in an effort to meet the demand.

Increased demand for labor management. Companies using SCM software to track their inventory are now turning their attention toward labor optimization and the ability to manage each worker more efficiently. These systems can create a list of tasks for a worker so he can complete multiple types of work in one trip.

Benefits of SCM Software

The benefits of supply management software are considerable:

Increased efficiency. First and foremost, SCM software is designed to improve the efficiency of your operation, from inventory check-in and storage to distribution and transportation. By making the processes electronic and/or automated, the time spent on these tasks drops considerably, which allows you to send more products out faster.

Reduced costs. The resulting efficiency reduces labor costs. In addition, many of the intelligence features are specifically designed to identify cost waste and eliminate it—for example, where commodities can be procured at lower rates, how to combine shipping to reduce to transportation costs or where to reduce inventory to maximize storage capacity.

Trend analysis and business intelligence. The intelligence features, in addition to helping control costs, can help improve revenues by identifying strongly performing products and guiding the user toward meeting market demand.

While these supply chain solutions do come at a price, proper implementation will usually lead to a calculable return on investment within a year.